Meta Description: Louisiana storms are tough, and the financial aftermath can be confusing. Learn how to navigate your homeowner’s insurance policy for roof repair and see why a local, experienced roofer is your most important partner in the process.

The Financial Aftermath: Understanding Your Homeowner’s Insurance Policy for Roof Repair in Louisiana

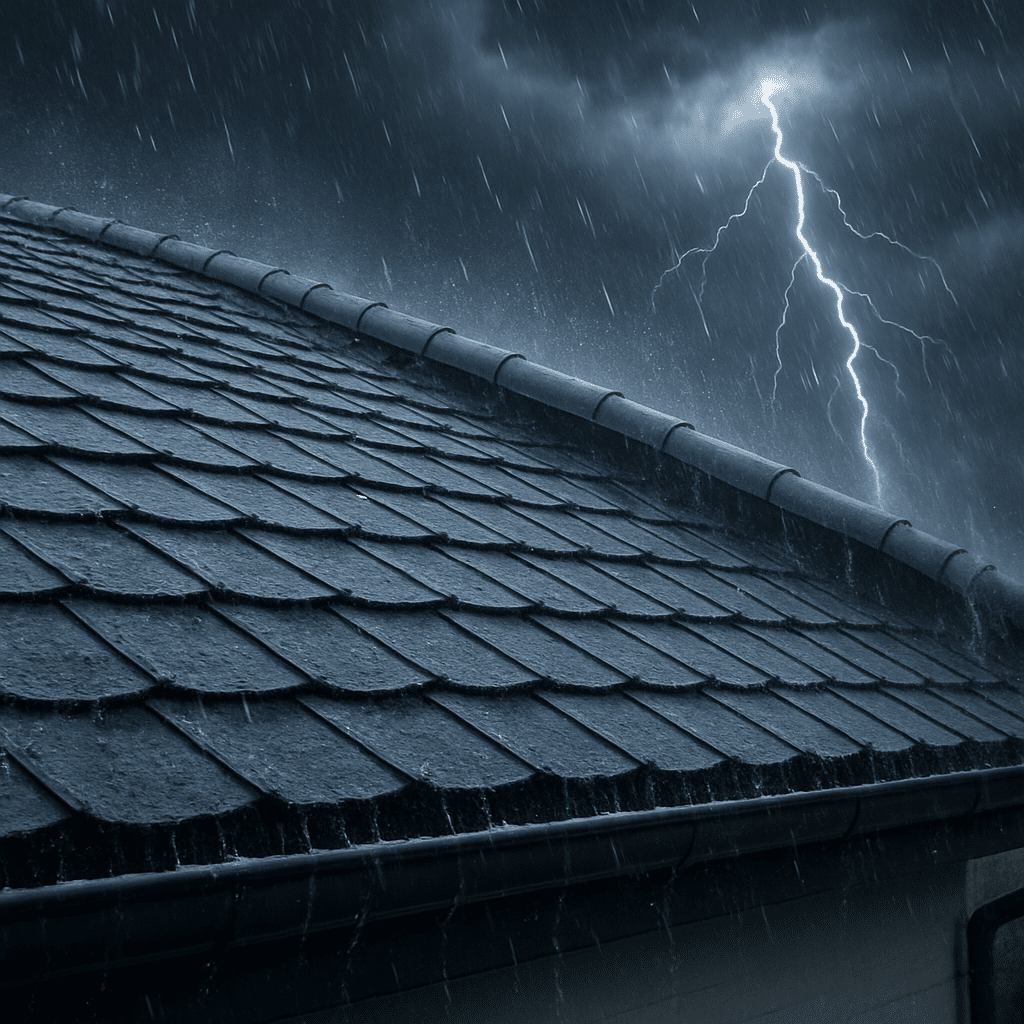

The wind has died down, the rain has stopped, and an unnerving quiet has settled over the neighborhood. The storm has passed, the adrenaline is fading, and now the big question looms: “What now?” For any Louisiana homeowner, this moment is all too familiar. You step outside, look up, and your heart sinks. The stress of assessing roof damage and facing the insurance process can feel more overwhelming than the storm itself.

Your homeowner’s insurance policy is supposed to be your financial lifeline in these moments. But let’s be honest—it often reads like a legal document written in a foreign language, filled with complex terms and confusing clauses. Making a mistake can cost you thousands.

This guide is here to change that. We’re going to demystify the insurance process for roof repair right here in Louisiana. We’ll walk you through the critical first steps, explain the terms that matter most, and show you how partnering with an experienced local New Orleans roofing contractor isn’t just a good idea—it’s the single best way to protect your home and your finances. Since 2012, Priority Roofing has helped thousands of Gulf South homeowners navigate this exact process, and we’re here to help you, too.

Key Takeaways

- Act Fast, But Safe: Your first priorities after a storm are ensuring your family’s safety, documenting all damage with photos and videos, and taking reasonable steps to prevent further damage (like tarping).

- Know Your Policy Language: Understanding terms like “Hurricane Deductible,” “ACV” (Actual Cash Value), and “RCV” (Replacement Cost Value) is crucial for knowing how much money you’ll actually receive from your insurer.

- Call a Roofer First: Before you call your insurance company, have a trusted, local roofing expert perform a thorough inspection. Their report gives you a powerful baseline to compare against the insurance adjuster’s assessment.

- Beware of Storm Chasers: After a major weather event, out-of-state companies flood the area. Partnering with a locally owned and operated roofer with a long-standing reputation in the community ensures accountability and quality workmanship.

First Steps After the Storm: Protecting Your Home & Your Claim

That feeling of being overwhelmed when you first see the damage is completely normal. The key is to channel that energy into a few immediate, actionable steps that will protect both your property and your future insurance claim.

Prioritize Safety Above All Else

Before you do anything else, perform a quick safety check from the ground. Look for downed power lines, leaning trees, or any other immediate hazards. Under no circumstances should you get on a wet, unstable, or damaged roof yourself. It’s incredibly dangerous and not worth the risk. Leave the high-up inspections to the professionals.

Document Everything (Before You Touch Anything)

Your smartphone is your most powerful tool right now. Before you move a single shingle or branch, create a detailed visual record for your insurance company.

- Take wide shots of your home from all sides to show the overall impact.

- Zoom in on specific damage, like missing shingles, dents from hail, or areas where flashing has been lifted. If you’ve noticed common signs of wind damage, capture them clearly.

- Head inside and take photos or videos of any water stains on your ceiling or walls, or active leaks. This helps connect the exterior damage to interior problems.

Mitigate Further Damage

Most insurance policies contain a “duty to mitigate” clause. This simply means you’re required to take reasonable steps to prevent the damage from getting worse. This is a crucial step to show your insurer you’re being a responsible homeowner. This can include:

- Placing buckets under active leaks.

- Moving valuable furniture or electronics out of the way.

- Hiring a professional roofer to place a tarp over the most damaged sections of your roof.

Taking these proactive steps demonstrates good faith and is essential for a smooth claims process. If you’re facing an urgent situation, knowing how to handle emergency roof repairs can be a lifesaver.

Decoding Your Policy: Key Insurance Terms Every Louisiana Homeowner Should Know

Opening your insurance policy can feel like you need a translator. But understanding a few key terms will empower you to have intelligent conversations with your adjuster and make informed decisions.

Your Deductible (Standard vs. Hurricane/Named Storm)

Your deductible is the amount of money you have to pay out-of-pocket before your insurance coverage kicks in. However, in Louisiana and other coastal states, it’s not always that simple. You likely have two different deductibles:

- Standard Deductible: A fixed dollar amount (e.g., $1,000 or $2,500) that applies to most claims, like a fire or a tree falling on your roof on a calm day.

- Hurricane/Named Storm Deductible: This is a separate, often much higher deductible that applies only to damage caused by a named storm (like a hurricane or tropical storm). It’s typically calculated as a percentage of your home’s insured value, usually between 2% and 5%. For a $300,000 home, a 5% hurricane deductible means you’re responsible for the first $15,000 of repairs. This is a critical number to know.

ACV vs. RCV: The Most Important Acronyms for Your Roof

These two acronyms determine how your insurance company will pay for your new roof, and the difference is massive.

| Term | What It Means | How It Works |

|---|---|---|

| ACV (Actual Cash Value) | The value of your roof today, including depreciation due to age and wear. | The insurance company pays you for the depreciated value of your damaged roof. This often isn’t enough to cover a full replacement, leaving you with significant out-of-pocket costs. |

| RCV (Replacement Cost Value) | The full cost to replace your roof with new materials of similar kind and quality, without deducting for depreciation. | This is the better coverage. You’ll typically get two checks. The first is for the ACV. Once you’ve completed the repairs and provided proof, the insurer releases the remaining amount (the “recoverable depreciation”). |

Most standard homeowner policies are RCV policies, but it’s vital to confirm. An experienced roofing contractor can help you understand which policy you have and what to expect.

Understanding Your “Peril” or Cause of Loss

“Peril” is the insurance term for the specific cause of the damage. Was it wind? Hail? A fallen tree? The exact peril matters because your policy may have different coverage limits or deductibles for different events. A professional roofer can help accurately identify the signs of wind damage versus hail damage, which is critical information for your claim.

The Insurance Claim Lifeline: A Step-by-Step Guide to Getting Your Roof Repair Covered

Feeling anxious about making a mistake during the claims process is normal. Follow this roadmap to stay on track and ensure you get the fair settlement you deserve.

Step 1: Contact a Trusted, Local Roofing Expert

This might seem counterintuitive, but your first call should be to a reputable local roofer, not your insurance company. Here’s why: An independent, professional roof inspection provides you with your own detailed damage report. This report, created by an expert who is on your side, becomes your playbook. You’ll know exactly what’s wrong before the adjuster even arrives.

An experienced local roofer, like Priority Roofing, knows exactly what to look for after a Louisiana hurricane or hailstorm. We document everything with the specific photos and terminology that insurance companies require.

Step 2: File Your Claim with Your Insurance Provider

Now that you’re armed with your roofer’s report, you can file your claim with confidence. Have your policy number ready, state the date the damage occurred (the date of the storm), and briefly describe the damage based on your photos and the professional inspection.

Step 3: Meet the Insurance Adjuster (With Your Roofer Present)

The insurance company will send their own adjuster to assess the damage. We strongly recommend that you have your chosen roofing contractor present for this meeting. Think of it as having your own expert in your corner.

Our team at Priority Roofing has worked with adjusters from every major carrier across the Gulf South for over a decade. We speak their language. We can walk the roof with them, point out damage they might overlook, and ensure the assessment is fair and comprehensive. This single step can be the difference between a partial repair and a full roof replacement.

Step 4: Review Your Insurance Settlement

After the adjuster’s visit, you’ll receive a settlement offer, often called a “scope of work” or estimate. It will detail what the insurance company agrees to pay for. Do not cash the first check until you have reviewed this document line-by-line with your roofer. They can spot missing items—like flashing, underlayment, or proper ventilation—that are essential for a quality roof but are sometimes left out of initial estimates.

Why Your Choice of Roofer is the Most Important Financial Decision You’ll Make

After a big storm, the sheer number of roofing companies can be dizzying. But in the financial aftermath, choosing the right roofing contractor is the most critical decision you’ll make.

Local Knowledge vs. “Storm Chasers”

Within days of a hurricane, trucks with out-of-state license plates will flood your neighborhood. These “storm chasers” swoop in, offer lowball prices, do quick, shoddy work, and are gone before the first leak appears. When you have a problem a year later, their phone number is disconnected.

As a locally owned and operated company since 2012, Priority Roofing is part of your community. We understand the relentless humidity and hurricane-force winds of the Gulf South because we live here, too. We’re accountable to our neighbors and have a reputation to uphold.

Expertise in Navigating Louisiana Insurance Claims

Not all roofers are insurance restoration specialists. Many are great at installing roofs but have little experience with the claims process. You need a partner who is an expert in both.

With thousands of projects completed and over 50 years of combined construction experience, our team brings unmatched knowledge of the claims process. We help ensure your settlement covers everything needed for a durable, high-quality residential roofing system that meets Louisiana’s tough building codes.

A Commitment to Quality that Protects Your Future

A cheap repair today can lead to another claim tomorrow. Your roof is your home’s first line of defense, and quality matters. We specialize exclusively in roofing. This focus allows us to deliver results that stand the test of time and Louisiana weather, giving you peace of mind long after the claim is closed. You can see the quality for yourself in our work.

Take Control of Your Financial Recovery

The aftermath of a storm is chaotic, but you don’t have to navigate it alone. By understanding your policy’s key terms, meticulously documenting the damage, and—most importantly—choosing the right local expert to be your partner, you can take control of the process. The right New Orleans roofer doesn’t just fix your roof; they act as your advocate, your guide, and your resource from the first inspection to the final nail.

Feeling overwhelmed by roof damage? Don’t navigate the financial aftermath alone. Contact Priority Roofing today for a free, no-obligation inspection. Let our local experts assess your damage and help you understand the path to recovery. Call us or fill out our online form to get started.